Dematerialisation of share certificates has become mandatory which means that every share certificate you hold has to be converted into an electronic form. This is where a dematerialisation request form comes into the picture where you request to dematerialise share certificates.

While the process has been kept simple for a user-friendly experience, a trader accustomed to holding physical share certificates might find it all too daunting. This article aims at simplifying the process of DRF for you.

What is the Dematerialisation Request Form

Let’s first understand what a dematerialisation form request is. Since transferring physical share certificates is mandatory, a dematerialisation form helps you request a depository participant to open a Demat account where you can hold all your share certificates.

A dematerialisation request form features important details like a unique identification number, the investor’s name, securities for dematerialisation, and security details making it crucial for you to fill the form diligently.

Before moving ahead with the process, take a look at these types of dematerialisation request forms:

1. Transposition-cum-Dematerialisation

If you are one of the investors in the physical shares, you can fill out the form given that the name on the physical share certificate is the same as the Demat Account.

2. Transmission-cum-Dematerialisation

Filled by one of the joint holders of the account in case of the death of other joint holders.

3. Normal Demat Request Form

Filled when all the joint holders are alive and the spelling of the names should be in the same order as the physical certificates bear.

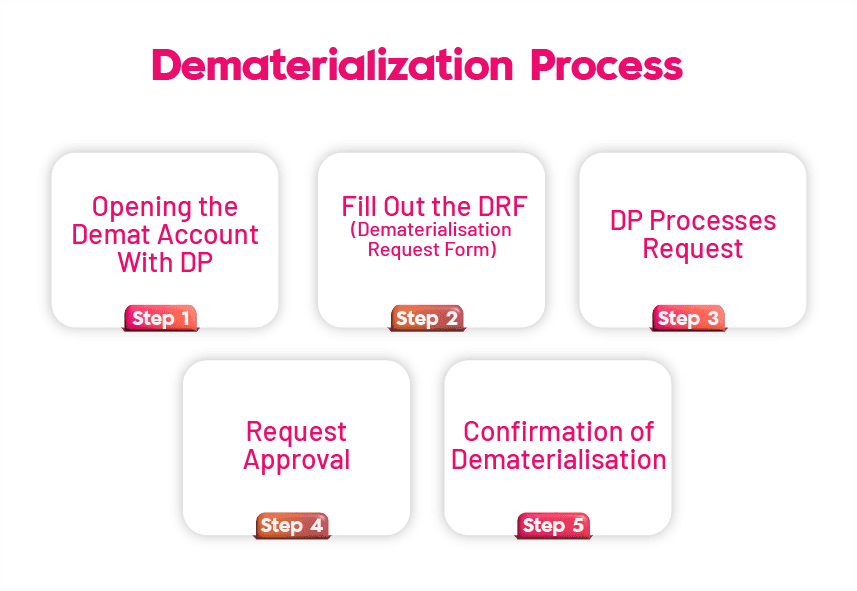

Dematerialisation Request Form: The Filing Process

To transfer your physical share certificates into an electronic form, filing a dematerialisation request form is required. Here’s how you can fill out the form:

Step 1: Choosing a Depository Participant

The first step is to choose a depository participant with whom you want to hold your share certificates. These depository participants work as the intermediary between the registered depository and you so make sure to choose a reliable DP.

Step 2: Providing Details

The next step is to provide your contact details and DRF submission and you will be provided with a unique Client ID. Fill in this client ID in the form.

Step 3: Account Holder’s Name

In this step, you have to provide the name of the account holder(s) in the demat account for which you are filing the request form.

Step 4: Face Value

You will be asked to provide the nominal value of the security mentioned in the physical share certificate you want to convert.

Step 5: Quantity of Shares

Along with the face value, you also have to provide the quantity of physical shares you wish to convert.

Step 6: ISIN

International securities identification number is a unique 12-digit code mentioned on certificates of different kinds of shares, bonds etc that you have to fill in the form.

Step 7: Details of the Security

You have to select the appropriate option to indicate whether your securities are locked or free.

Step 8: Folio Details

In case your securities are linked to any folio, make sure to provide the details.

Step 9: Verification

Once you have provided all the above-mentioned details, you have to attach your signature to authenticate and verify the information provided.

Step 10: Declaration

Cross-check all the information you have provided and declare your agreement to abide by the rules of dematerialisation.

Step 11: Fill out the ISR-2 Form

Lastly, you have to fill out the ISR-2 Form to declare that your securities are held by a bank. Provide details like the name of the company, security type etc.

Wrapping Up

Demat Account opening has revolutionised trading in the stock market for Indians by offering a streamlined process and eliminating the chances of theft, fraud or loss of physical share documents.

Following the above-discussed steps you can transfer physical share certificates into electronic form, conveniently. Remember that a dematerialisation form is the key to transferring your share certificates so make sure to provide the details carefully.